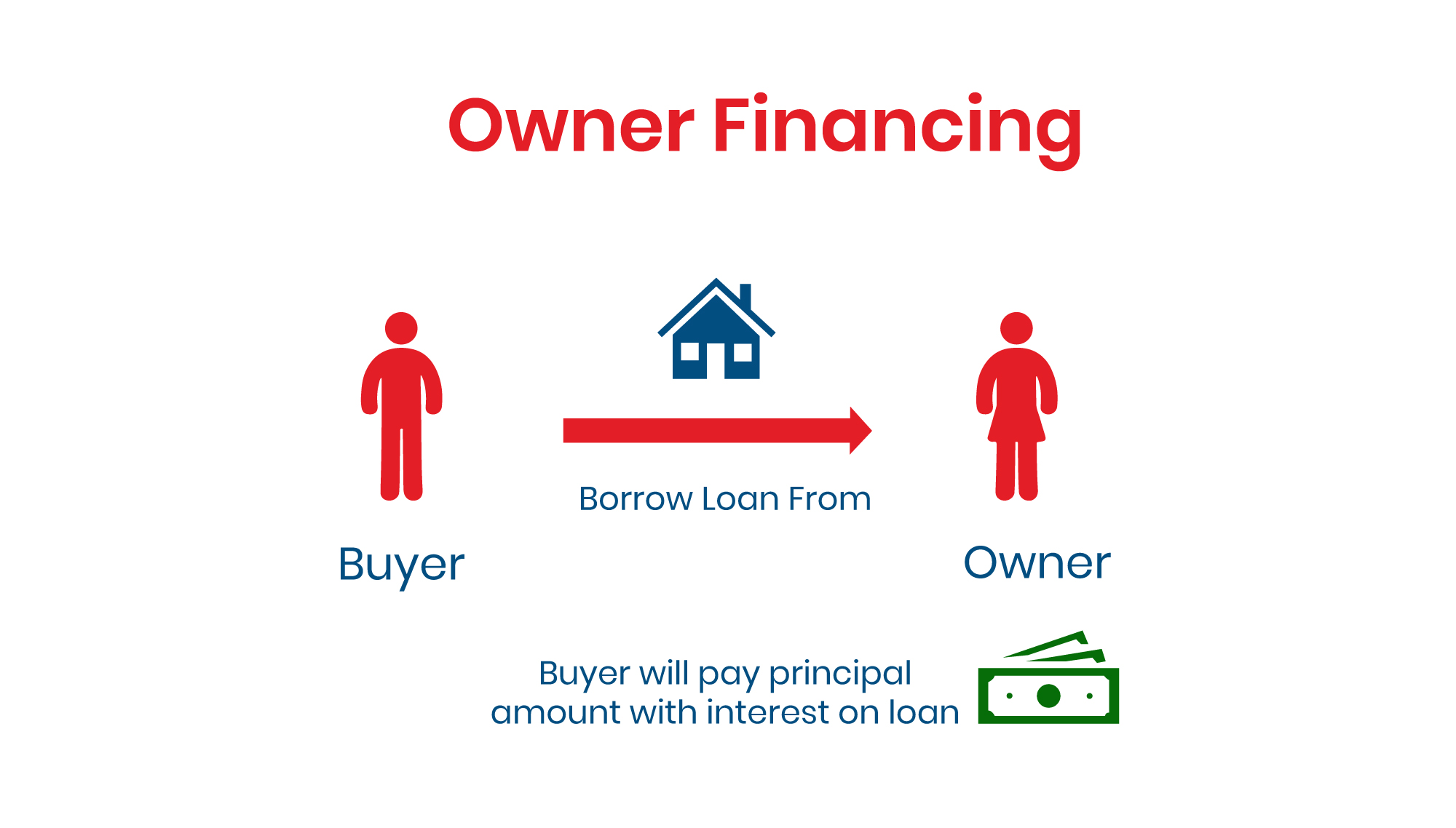

What is Owner financing?

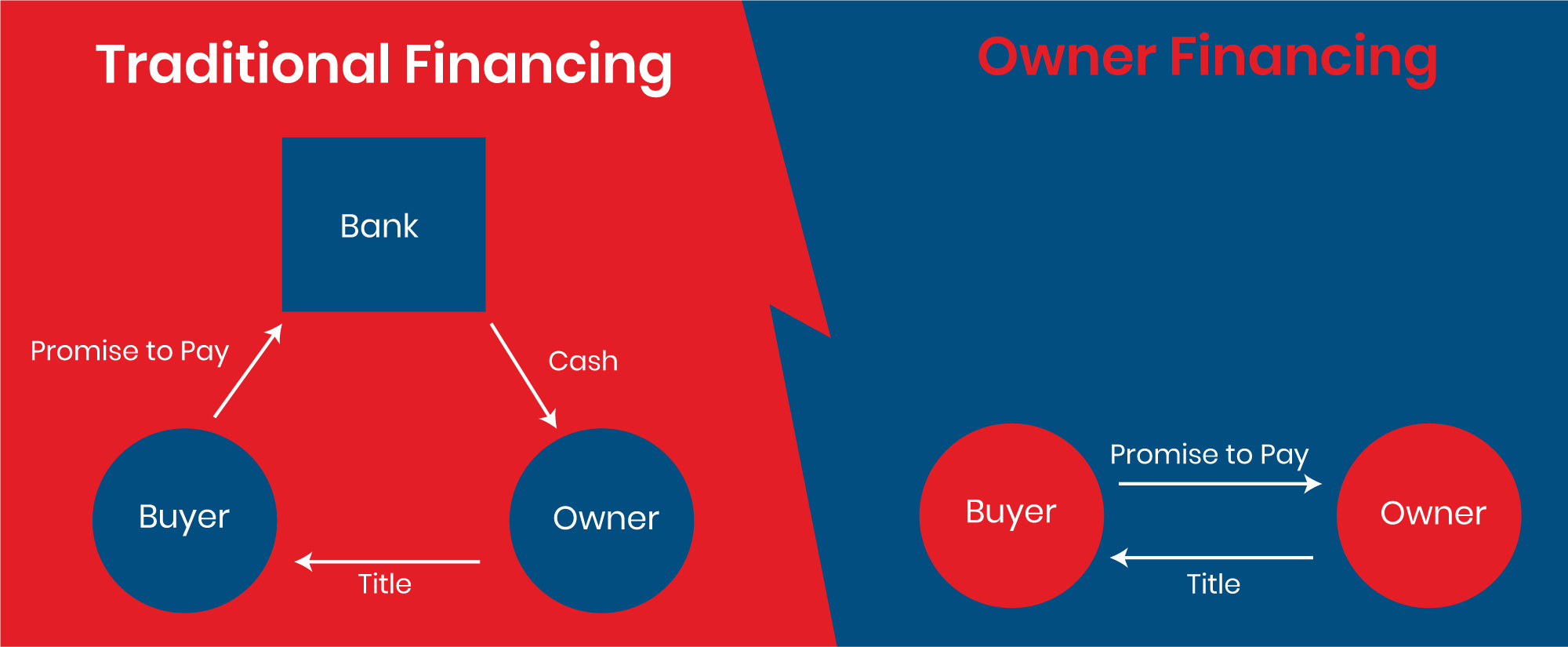

Owner Financing is a real estate agreement in which the seller handles the mortgage process instead of a financial institution. Instead of applying for a conventional bank mortgage, the buyer signs a mortgage with the seller. Owner financing is another name for seller financing.

Benefits of Owner financing

Benefits For Sellers

- Ability to sell the property quickly and save on closing costs

- Can produce significant capital gains tax savings over time

- A steady stream of income from the payments and interest on the loan.

- Faster time to reach a sale, and ability to sell your property as-is without the need for repairs

- Released from property tax, homeowners insurance and various maintenance expenses

- Option to sell the promissory note to an investor

Benefits For Buyers

- Greater access to financing opportunities

- Lower expenses associated with closing costs

- More flexible agreement terms

- More accessible for those with less-than-perfect credit.

- In a seller-financed sale of a home, the buyer purchases directly from the seller and both parties handle the arrangements.

- Often seller financing includes a balloon payment several years after the sale.

- There are risks involved when financing a sale of a home. For example, If the buyers stops paying, you, the seller, could incur legal fees, and have to proceed with foreclosure proceedings or an eviction order.

For sellers, financing the buyer’s mortgage can make it much easier to sell a house. During a down real estate market, and when credit is tight, buyers may prefer seller financing. Moreover, sellers can expect to get a premium for offering to finance, meaning they are more likely to get their asking price in a buyer’s market.

Seller financing rises and falls in popularity along with the overall tightness of the credit market. During times when banks are risk-averse and reluctant to lend money to any but the most creditworthy borrowers, seller financing can make it possible for many more people to buy homes. Seller financing may also make it easier to sell a home. Conversely, when the credit markets are loose, and banks are enthusiastically lending money, seller financing has less appeal.